Cash access remains essential for customers, even in a digital-first economy. For business owners, installing an ATM offers more than convenience — it can create a steady, measurable revenue stream with minimal upkeep. Yet, profitability doesn’t come from chance. It comes from planned placement, usage patterns, and a strategic setup.

When you understand how these drivers work, your ATMs’ passive income becomes a valuable asset that supports business growth and customer satisfaction. From estimating transactions to optimizing surcharge income, each factor plays a role in long-term returns. Here’s how you can evaluate and maximize those opportunities to ensure each cash withdrawal adds value to your customers and bottom line.

How to Estimate ATM Transactions From Foot Traffic

Location plays the biggest role in ATM revenue, and estimating your potential earnings is simple when you look at three key factors:

- Daily foot traffic

- Average usage rate

- Surcharge amount

Most ATMs in retail environments see about a 5% usage rate, meaning roughly five out of every 100 people will typically use the machine. Here’s the formula we use to estimate monthly profit:

Daily foot traffic × 0.05 (5% usage rate) × surcharge amount × 30 = estimated monthly profit

Using this approach gives you a clear, accurate picture of what your ATM can earn each month. It also helps you plan cash loads, understand demand, and choose the best placement inside the business. This way, your machine becomes a convenient, trusted part of customers’ daily routines.

For example, a busy gas station with 800 daily visitors and a 5% usage rate would generate around 40 daily transactions, or roughly 1,200 monthly transactions. A smaller business with 200 daily visitors can still maintain steady and reliable transaction volume, especially when customers visit frequently or rely on cash for certain purchases.

The ATM ROI Calculator

How much an ATM makes depends on understanding how each cost and income variable connects. Calculating return on investment (ROI) is a function of clear inputs, predictable transaction patterns, and disciplined financial tracking. With a few data points, you can estimate both your monthly earnings and payback horizon, creating a practical decision-making roadmap.

Core Inputs

A reliable ATM business ROI model starts with accurate inputs:

- Surcharge fee: The surcharge is how ATMs make money. This is the fee users pay at the ATM, typically ranging from $2.75 to $3.75 per transaction.

- Merchant commission: The merchant commission is a percentage of surcharge revenue, paid to the business hosting the ATM.

- Maintenance and travel: Routine upkeep and periodic preventive maintenance are included in maintenance and travel costs, which vary by location.

- Vault cash: The vault cash is the working capital loaded into the ATM, typically ranging anywhere from $2,000 to $10,000, which ties up funds until they are recycled.

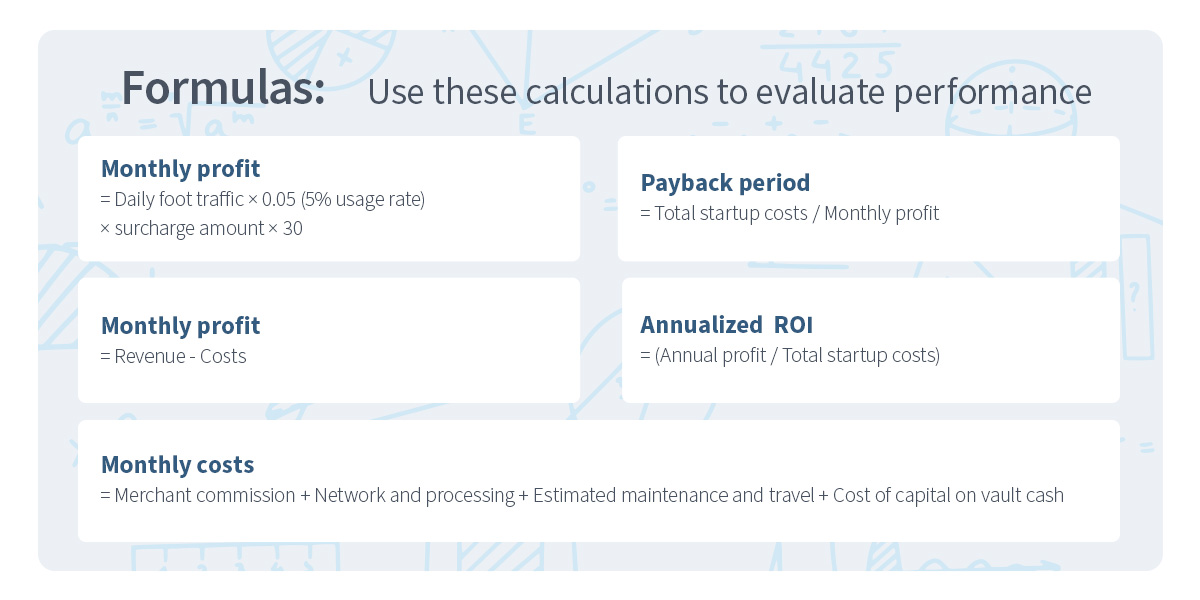

Formulas

Use these calculations to evaluate performance:

- Monthly profit = Daily foot traffic × 0.05 (5% usage rate) × surcharge amount × 30

- Monthly costs = Merchant commission + Estimated maintenance and travel + Cost of capital on vault cash

- Monthly profit = Revenue – Costs

- Payback period = Total startup costs / Monthly profit

- Annualized ROI = (Annual profit / Total startup costs)

Sensitivity Analysis

Transaction volume and surcharge rate affect your ROI. A small volume increase, say from 900 to 1,100 transactions, can raise annual profits by over $4,000, while a $0.25 surcharge increase can have a similar effect.

Costs such as maintenance and processing are relatively stable. That means the focus should remain on location-driven foot traffic and a balanced, competitive fee strategy to sustain growth and maximize returns.

ATM Location Scorecard

Objectively evaluating sites before committing to a location for your ATM helps forecast long-term returns and how the ATM will boost business. A location scorecard provides a structured way to compare options using measurable criteria. Location ranking factors include:

- Foot traffic: Track the average daily visitors through merchant data. ATMs near college campuses, in busy convenience stores, and at corner markets are good options.

- Cash orientation: Identify the frequency at which customers pay in cash. Cash-only or cash-preferred environments generate higher ATM usage.

- Competition: Fewer nearby ATMs typically result in higher transaction volumes. Check the surrounding areas to compare rates and determine numbers.

- Hours of operation: Locations that are open late or 24/7 naturally produce more transactional opportunities.

- Location visibility: Machines near entrances outperform those tucked in store corners.

- Security and lighting: A safe, well-lit setup encourages repeat use.

Weigh each factor based on your priorities. For example, foot traffic and cash orientation may each account for 25% of the total score, while safety and visibility account for another 25%.

Maximizing ATM Performance and Uptime

ATMs are still profitable, even in a digital-first world. However, they need ongoing management to keep profits consistent. An in-store ATM adds value to businesses by reducing banking expenses and optimizing cash flow. Additionally, when customers withdraw cash before making purchases, they may be more likely to make impulse purchases, which increases business sales and directly contributes to your operational bottom line. A consistently stocked ATM signals reliability, which keeps customers coming back to your location.

High-performing operators track two key metrics — uptime and cash availability rate. Aim for a minimum of 98% uptime and ensure the machine never runs out of cash during peak hours. Using remote monitoring tools can automate alerts for low balances, paper jams, or network errors, allowing for quick resolution.

Routine preventive maintenance, which should include cleaning card readers, verifying receipt printers, and updating software, reduces service calls and protects hardware lifespan.

Consistency builds reputation. When customers know your ATM always works and has cash, repeat usage increases. This reinforces the long-term profitability you projected through your ROI model.

Work With ATM Money Machine

ATM profitability depends on informed decisions, including selecting the right location, tracking realistic transaction volumes, and managing operations with precision and efficiency. When every variable is measured and optimized, your ATM can become a reliable source of revenue. Successful owners treat their machines like financial assets — driven by the right data and diligence.

At ATM Money Machine, we deliver nationwide ATM processing, sales, and support. Your ATM arrives ready to start delivering on your ROI. It’s preprogrammed, fully compliant, and simple to activate. Additionally, we offer expert support from real people whenever you need it. Get on-site repairs, phone guidance, access to replacement parts, and real-time technical assistance.

To buy an ATM for your business or start your own ATM business, contact us online today or call 609-641-7300.